When you’re just starting out, life insurance may not be your first concern. Putting it off may cost you.

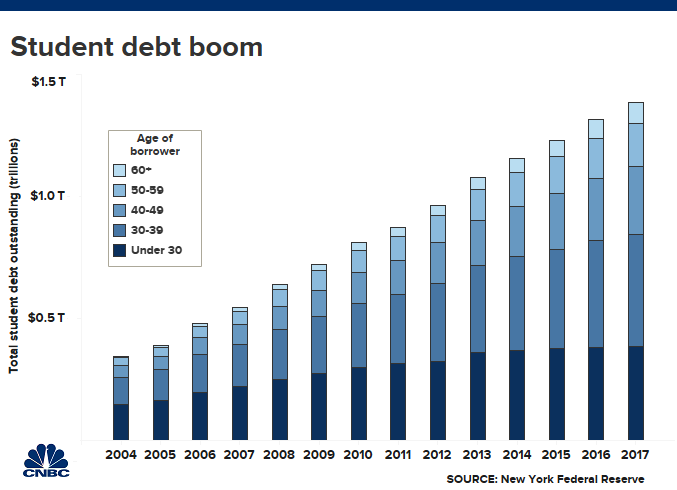

Research shows that millennials, who are saddled with hefty student loan bills, have struggled to set money aside for other purchases — from life insurance to buying a home.

On average, about 7 in 10 seniors graduate with debt, owing around $30,000 per borrower.

However, life insurance comes with a specific benefit for student loan borrowers: A policy that covers the amount owed to lenders can act as a way of protecting those loans from becoming a loved one’s burden.

Though outstanding federal student loans are discharged when you die, that isn’t always the case with private loans. When a borrower with a private loan dies, the co-signer may be on the hook for subsequent payments.

About half of private student loan programs do not offer death discharges, according to SavingforCollege.com.

More from Invest In You:

Not having a long-term care policy can crush your financial plan

When it pays to buy travel insurance

Don’t make this $42,000 mistake

Or, like with outstanding student debt, if you took out a loan to start a small business, or any type of unsecured loan, that loan balance doesn’t die with you either. The lender can either size the collateral you used to secure the loan or eat up all of your assets to pay off the debt.

A life insurance plan can also provide the business with the resources to recover from financial losses in the event of an untimely death.

Generally speaking, life insurance makes sense whenever there are financial needs that could not be covered by your assets if you were to pass away.

How to find the right policy

Most financial advisors suggest young adults start out with a term policy to get maximum coverage for the least amount of money.

Term life insurance offers coverage for a set period of time, say 20 years or 30 years. Once the term has expired, the policy terminates, unless you renew it for another term or convert it to a permanent or whole life policy, which can be much more expensive.

Whole life insurance, on the other hand, offers coverage for the remainder of your life as long as you pay the premiums. These policies come with a cash value account that accumulates on a tax-deferred basis.

The cost of life insurance depends on how much and which type you get. It’s often less expensive than people expect.

A healthy 30-year-old man can expect to pay just under $18 a month for a 20-year term life insurance policy with a $250,000 death benefit, according to Policygenius, an online insurance marketplace. The average premium for a woman of the same age is about $15 a month.

A good rule of thumb is to aim for a death benefit that’s equal to 5 to 10 times your income. A financial planner can help you get a more accurate picture of the amount of protection you’ll need.

Life insurance will only get more expensive the longer you put it off. Insurance premiums rise by an average of 8% to 10% for each year you postpone buying coverage, according to Policygenius.

Millennials are on the cusp of surpassing Baby Boomers as the largest living adult generation in the U.S. in 2019, according to PEW Research.

Caiaimage/Paul Bradbury | Caiaimage | Getty Images

There are a wide range of offerings from MassMutual to MetLife. Small or medium-size insurers aren’t necessarily bad, but you do want to know that the firm has a good track record.

Find out about the company’s history in the life insurance business and check its record through the National Association of Insurance Commissioners’ database.

A number of websites will help you compare rates and buy policies through their sites, such as Policygenius.com, as well as sites that allow you to buy a term policy directly on their platform, like the start-up Fabric.

CHECK OUT: Suze Orman: ‘Do not let these markets scare you — you want these markets to go down’ via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.